Mileage for work is not only about counting the miles you drive. It is about making sure that every trip you take in your car for business actually helps you. If you use your vehicle for work purposes such as meetings, deliveries, or site visits, you should track those miles and claim the right expenses. Despite what type of car you drive, knowing how to calculate your business mileage will save you money and reduce taxes.

Claiming mileage for work can get thousands of dollars back in your pocket each year. According to IRS data, 73% of Americans don’t track their business driving expenses. Meaning, they are missing the chance to get their money back. Don’t make the same mistake and learn what to do through this blog.

Mileage for work is the miles you drive between work locations, client visits, business meetings, conferences, or supply runs. Based on the IRS definition of deductible work miles, only driving for business purposes (not including commuting to your regular workplace) is considered business mileage. Therefore, your daily travel from home to your regular workplace isn’t part of business miles.

Let’s take a look at the example for more clarification. Imagine you need to drive from your current office to a client’s location for a meeting. Then, you should stop by a supplier to pick up materials before returning to the office. In such a case, all the miles you drive will be considered as work-related miles and count as mileage for work.

Mileage is an essential part of calculating work mileage. It determines how much you can save on taxes and get reimbursement. There are different ways to track work mileage.

Some people prefer to stick to the traditional way and use a logbook. They write down all the data, destinations, the purpose of the trip, and the total miles they covered. While others might use modern devices and apps for tracking the data. Such apps use GPS technology and automatically record your routes and mileage. They also minimize the risk of you forgetting to record the trip.

Regardless of the method you choose, you should make sure that you have the information regarding the date, starting and final locations, the purpose, and how many miles you drove. This data will be essential if the IRS or an employer asks you for proof to claim the mileage.

To calculate mileage for work, you need to multiply the total mileage by the IRS standard mileage rate. This is the easiest and most common way of calculating work mileage. The IRS rate is updated every year, so you need to check the updated rate annually. For 2025, the standard rate is 70 cents per mile for using a car on business purposes.

Now, let’s discuss how to calculate work mileage with a real case scenario. Assume you have driven 1,000 miles, and the purpose of your trip was business travel. As the current IRS business rate is 70 cents per mile, your deductible amount would be:

1,000 miles × $0.70 = $700

Although this is a commonly accepted method, some companies may have different policies regarding reimbursement. Hence, you should clarify what approach your employer has. However, no matter which method they have, you should always keep all supporting documentation and data.

Several key factors might significantly impact your work mileage deductions and reimbursements. These factors will directly affect how much money you can save or earn back from business driving. These are the most important things you need to consider:

To claim mileage on H&R Block, on their platform, under business deduction or Schedule C, you will find the vehicle expense section. Here you can see all the details for reimbursement. Let’s go through this process together step by step.

Step 1: Find the “Deductions” section

Step 2: Select “business Expenses” or “Vehicle Expenses”

Step 3: Choose between the standard mileage rate or actual expenses

Step 4: Write your total business miles

Step 5: Put your vehicle details

Step 6: Upload your mileage log as supporting documentation

After following these steps, H&R Block will automatically calculate your deduction. If something is not correct, the software will also show potential issues that you need to fix.

The number of miles you drive every year has a significant influence on how your business mileage is calculated and compensated. More yearly kilometers typically equates to more fuel expenses, more maintenance, and increased wear and tear. If the majority of your miles are for business, you may usually claim higher deductions or receive more compensation. Fewer mileage result in cheaper expenditures and smaller deductions. That is why it is critical to keep accurate records of your annual mileage. Good records help you maximize your tax benefits and provide reliable documentation if your employer or the IRS requests it.

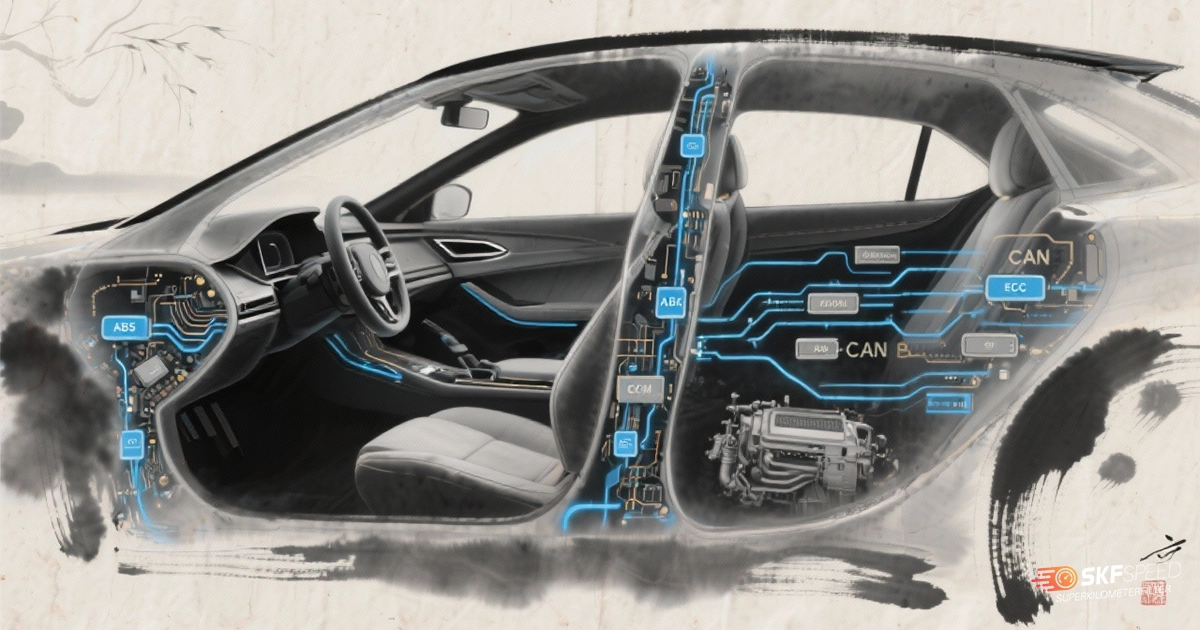

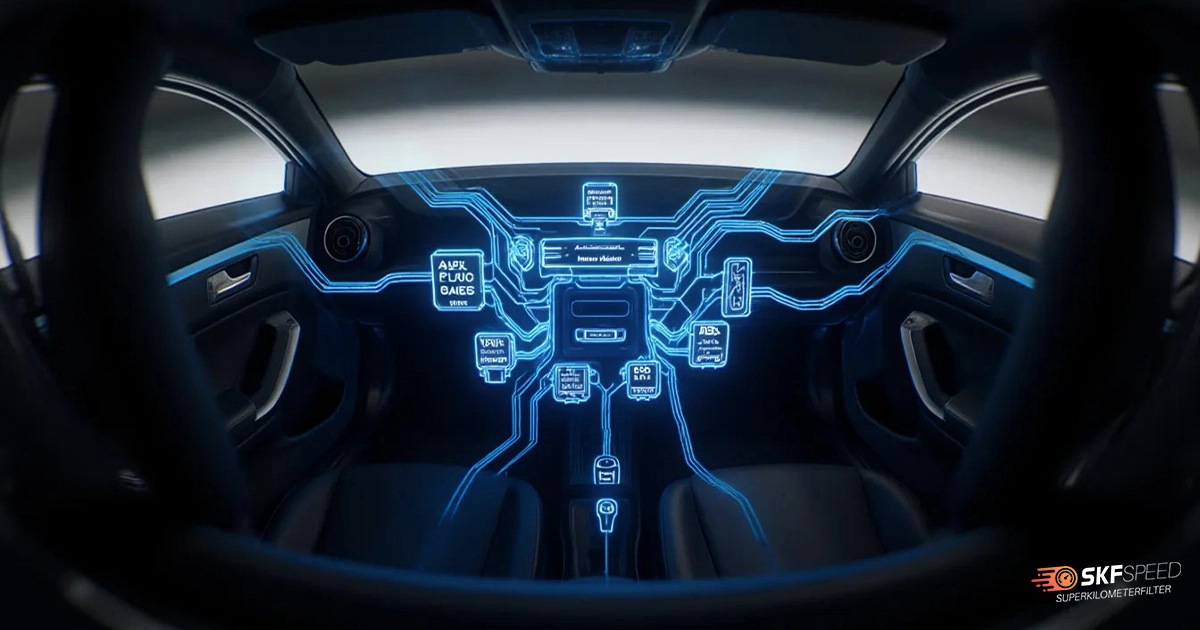

The Mileage blocker is a smart device that stops mileage tracking while your vehicle is running. It prevents the system from registering and storing mileage in ECUs. Hence, your covered mileage is completely untraceable.

The mileage blocker from Super Kilometer Filter (SKF) comes with a mobile application that gives you full control of the device via your phone. And how reliable is this tool?! The gadget is made of premium components and offers seamless functioning even in severe conditions. Furthermore, the mileage blocker has several options from which to choose the one that best suits your needs. Remember that this device is for only vehicle testing and tuning, not for everyday driving on public roads.

The SKF mileage blocker has easy installation guidelines. This will help you install it by yourself without additional need for professional help. You can buy the mileage blocker module online from the SKF website. In case of any further questions, please contact our customer support team.

Mileage for work is one of the easiest ways to put money back in your pocket if you drive for business. By tracking your trips accurately and knowing how to calculate them, you can make sure you get every deduction or reimbursement you deserve. Keep good records, use helpful tools, and follow IRS rules so you can get the most out of every work mile you drive.

Here you will find all the details about our company

Here you will find shipping and return related information

Here you will find information on all technical questions

Here you will find helpful information about installation